Introduction

The recent DeSoc paper by Vitalik Buterin, Glen Weyl and Puja Ohlhaver has generated a huge amount of excitement and debate in the crypto community, and for good reason. It is an articulation of a future for decentralised technologies that extends beyond the purely financial games of the current market.

It does so by proposing “Soulbound Tokens”, or SBTs, which are principally non-transferable NFTs which can be utilised in a range of ways to realise decentralised identity and consequently begin to bridge web3 tech deeper into human use cases.

This has always been the interesting bit to me–the moment where we start plugging humans into blockchains; “the social layer”. This is where DAOs live: web3 social media, decentralised sense-making systems, DeSci, collective intelligence tooling, and radical new social consensus systems. The good stuff.

I’ve been thinking about use cases like those contained in this paper for a long time. Yes, that makes me sound like a crypto hipster (I totally am), but we do have quite a bit of real tech built around these ideas, some of which I’ll unpack in this article. I’ll be honest though, there’s been a few moments exploring this stuff where I’ve had more than a bit of an “oh shit!” moment. This stuff can get dark.

You see, where this development trajectory takes us can go into a few different directions, some down the path of hippy friendly solarpunk utopias, some towards the kind of Orwellian dystopias that would make George wince.

This article is about a bit of both.

Decentralised Identity

This is kinda what it’s all about. There was quite a bit of backlash from this paper from people who are well into VCs. No, not the kind that dump their bags on you, but the ‘Verifiable Credentials’ kind. VCs are a web standard that is concerned with how to handle identity online. The DeSoc paper drew quite a bit of scorn from the type of person that likes to say things like, “lol cryptobros re-inventing the wheel again” or something equally banal. Mostly, these people completely missed the point. This is all about tokens.

Tokens + smart contracts = 🚀

Well, normally anyway. Vitalik et al seem to think we’ve had way too many rockets recently and it’s time to turn them off. Making these tokens non-transferable means we get to move away from all that hyperfinancialisation that turns us all into apes (we honestly did take this too far) and still get the affordances of tokens interacting with smart contracts, whatever off-chain metadata scheme we desire and the ability to revoke them, etc. This new fangled token that doesn’t move will theoretically allow us all to transform into the bipedal civilisation lovers we have the potential to be.

This is actually where I diverged on this idea many crypto moons ago way back in ye olde 2020 when we launched finance.vote. We developed an idea we called ‘Decentralised Identity Tokens’ (DITs) and used NFTs to act as identities that carried reputation, token balances and quadratic voting histories to be used in prediction markets (sound familiar?). We discussed making them non-transferable for ages, but we decided that since we were gonna give them cool, potentially mega valuable art, it would be insane to brick them, so we didn’t. More on this later.

Anyway, what this paper is really about is allowing tokens to be more than just financial objects. Rather it is about allowing them to pick up ‘attestations’ that allow your account, or “soul”, to become a nuanced multi-faceted decentralised identity, opening up the wonders of decentralised sociality.

The Good

Radical Markets Land

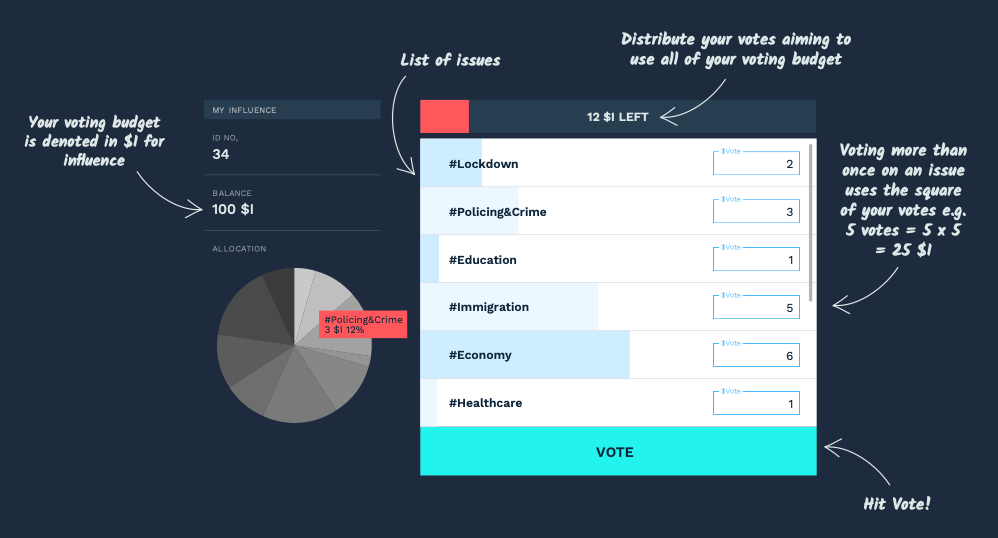

Those of you who have followed basically any of my work will know that I’ve been incredibly influenced by Glen Weyl and Eric Posner’s work over the years. I was nerdy enough to read their papers prior to the release of their book Radical Markets and have basically been obsessed with quadratic voting (QV) ever since. I’ve even invented a new spin on it that I call ‘semantic ballot voting’, which is used extensively across the finance.vote project and is now core to the governance design of FactoryDAO.

QV is mentioned extensively throughout the paper for good reason; it is bound to be a fundamental primitive for DeSoc. I’m also fairly sure the lineage of thinking that led to both my exploration of NFT identities and that of SBTs is motivated by a common question, “How do you do sybil-resistant quadratic voting?”.

The thesis of the DeSoc paper is that the means of getting there, without downloading everyone’s passport onto the blockchain (which still wouldn’t really work), is to do something like SBTs to build out a kind of organic ball of reputational identity that’s difficult to fake.

Economic Experiments

I’m of the persuasion that the metaverse will be a kind of digital sandbox for the future of economics: a place where we can experiment with property rights by using digital ape land, or whatever, instead of having to mess with sacrosanct things like IRL property rights.

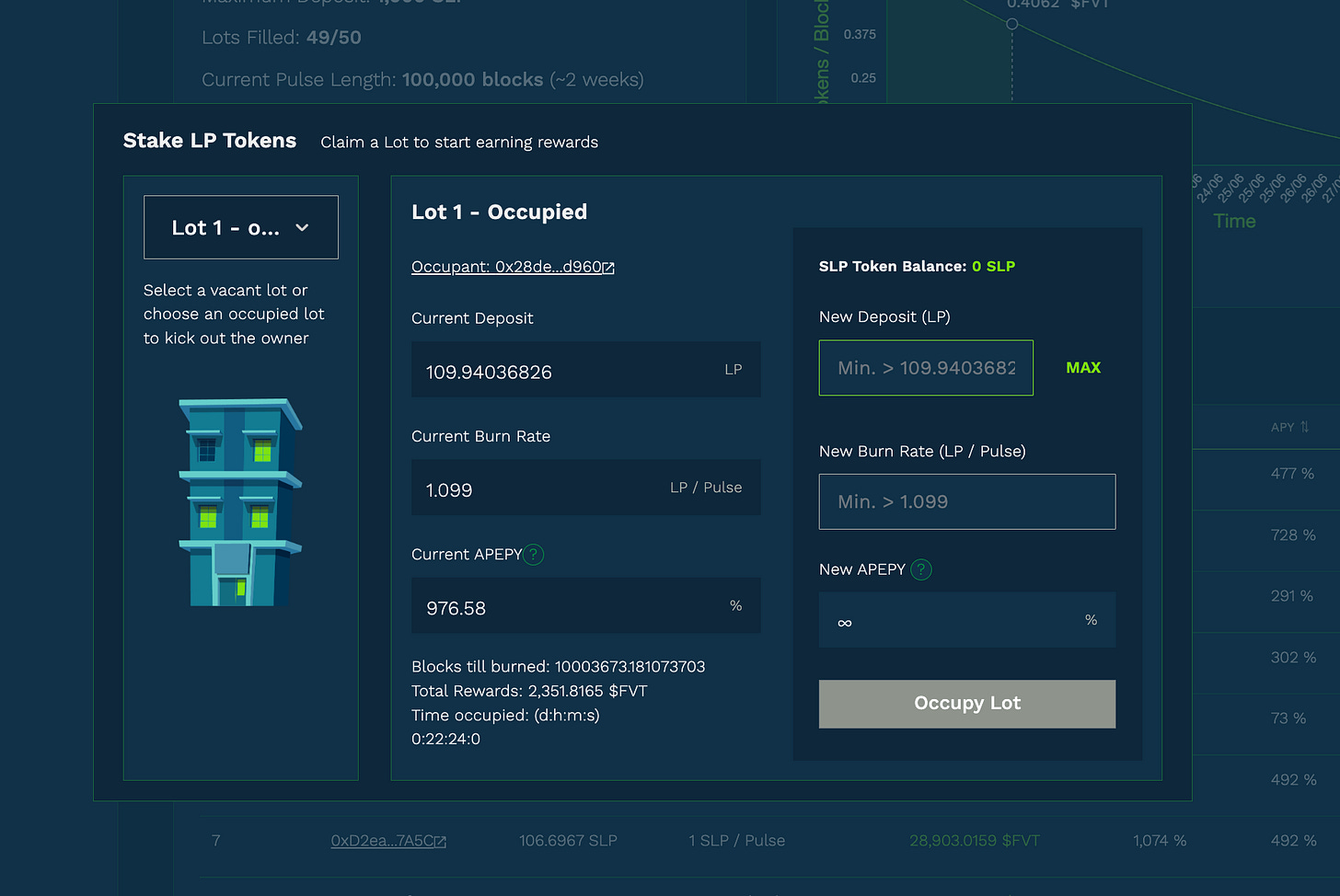

Again, we actually went and built a Harberger Tax world of “protocol properties”, which we use to allow a DAO to manage its liquidity mining programmes. This generated such interesting results that I wish I could just take a few months of work to study it all. SBTs and the plural property idea outlined in the paper are super exciting.

Soul DAOs

We’ve been doing NFT governance since 2020 and I’m convinced it is going to open up the next era of DAOs. Humans are non-fungible, so it follows that governance should be too. In fact, the scheme of quadratic voting that we’ve built is designed to open up reputation dynamics, whereby the budget of voting credits each NFT can hold can be nuanced through non-financial means i.e. by earning reputation in the DAO. Again, I’m basically all in on this idea.

Futarchy and Prediction Markets

This is what finance.vote is all about and a chunk of the paper describes something we put into practice for over 60 weeks. We recently retired the first version because it had devolved (relevantly) into a kind of sybil-off between about 5 accounts.

The way it worked was that users voted with their NFT identity to vote on a basket of tokens. If they had votes on a winning token, then they won a share of a pot of tokens. It was a kind of play-to-earn game where you were rewarded for making accurate bets with both money and reputation. We got this fully decentralised with Chainlink Oracles and it was actually really popular for a while. We did this on mainnet but unfortunately the game kinda got ruined by becoming super expensive to play (thanks Ethereum). We’re rebooting this soon on a cheaper chain (Polygon we think) and potentially with SBTs..

Plural Sensemaking

This is where I think it could get super interesting and again is something we’ve been exploring for over a year with an idea we call semantic governance where people sense-make around certain topics (hashtags) through a combination of quadratic voting and dialogue formation. The idea of forming a decentralised identity with reputation that nuances your influence across domain specific expertise has been one the major drivers of my research for years now; plural sensemaking is the perfect way to describe it.

Souls meets DeFi

There are of course quite a few bits we haven’t got close to trying yet, probably because they weren’t SBTs. The idea is that you use the identity you have accrued in the system to build out a kind of decentralised credit score allowing you to get under-collateralized loans and the like. Very exciting and I’m sure there’s a hundred startups forming right now that will be running at this.

The Bad

The Non-Transferability

I’m not that sold on the non-transferability thing. We certainly saw some of the problems of users buying up multiple tokens, but it was nothing we couldn’t really work around by identifying sybils in the system. Also, QV is designed to smooth out plutocratic power by making voting exponentially costly, which also offsets a lot of these issues. We just haven’t seen loads of people splitting token balances between lots of different accounts.

We did have one vote descend into an all out sybil war (two sybils fighting over a vote outcome), but this shook out who the sybils were and we could then block those actors out from important future votes.

Also, we’re super bullish on NFT DAOs, mainly with NFTs using their super pretty art pieces (or not so pretty as the case may be) as voting identities, with the aesthetics of the piece allowing users to build their metaverse identity within a governance space. Bricking their transferability and the secondary market is not something we expect many NFT projects to want to do.

Still, I get it, and it can be possible for SBTs to manipulate their metadata to flair up their identities with aesthetic qualities, but I’m not sure if that just ruins the whole value of them. That’s the point I guess, but I do worry that this will be a serious adoption limiter for SBTs. Speculation makes the crypto world go round, and I can’t see many degens apeing into static tokens that there’s no exit from. The idea that we’ll grind away at building a reputation so that we get some power in a decentralised society is still a bit utopian for now.

It’s Social Credity

I mean the paper totally leans into this and owns it and that’s fair enough, but it does handwave away that this is basically the social credit system for degens.

It’s ok though, because it’s bottom-up, rather than top-down! Except it probably won’t be, because some of the mad loons that will try this stuff will either go for the max top-down authoritarian approach since it’s easy and it will tickle the fancy of those who think “putting the people in charge will never work”, etc.

Also, can it ever really be bottom-up? If you have full consent over your SBT, with someone assigning a reputation score you don’t like, why would you accept it? These power dynamics are going to be interesting to watch and I doubt they’ll all go the utopian way.

The Name

Yeah I know there’s been a whole load of people moaning about this, but I do think there is a real branding issue with the “soulbound” thing. It evokes some vivid imagery of digital objects indelibly bonding to your being in ways that you can’t get them off. It’s existentially creepy.

My preference is NTTs (non-transferable tokens). Yes I know they can be revoked, etc., but the aggregate user experience is you can’t transfer them. Anyway, it’s almost certainly too late now because of..

Vitalik Power

Vitalik says jump and everyone says, “How high should the valuation of my soulbound seed round be?”

It’s kind of miraculous really. Vitalik drops a highly technical paper on danksharding or something and a hundred teams atomically jump into action building his dreams. No judgment here, I’m one of them.

I actually think this is kinda fascinating, and it’s actually a wondrous example of decentralised governance. There’s no command here, it’s just Vitalik being “V God” (what I’ve seen some Chinese DAO members call him).

Of course, Vitalik has earned this power and deserves every inch of it, but when it comes to inventing decentralised social credit systems, there is a danger of thousands of distributed degens uncritically making this stuff without too much consideration of the ethical and moral implications of the technologies that are made.

Which brings me to..

The Horribly Dystopian

Pick your Dystopia

There’s a reasonably chilling section of the paper in which we just flat out accept that some of this can lead to dystopian outcomes:

“DeSoc does not need to be perfect to pass the test of being acceptably non-dystopian; to be a paradigm worth exploring it merely needs to be better than the available alternatives. Whereas DeSoc has possible dystopian scenarios to guard against, web2 and existing DeFi are falling into patterns that are inevitably dystopian, concentrating power among an elite who decide social outcomes or own most of the wealth”

Even though it troubles the hell out of me, I agree with this. We’re already deep into the Web2 dystopia path. All of us are clicking away for dopamine hits, posting microvids about what pants we’re wearing, consuming nation state propaganda and relentlessly falling out with each other about basically everything. All the while our attention sold to the highest bidder. Grim.

This is only going to get worse as the full arsenal of mind control machinery gets commodified to the point where we fully lose grip on reality as everyone from the CCP to Bitclout gets fully into the reality distortion game.

So, we try our best to steer Web3 in a better direction dancing the dance of trying not to build a hyper-surveillance panopticon. Lovely.

YOU ARE CANCELLED

The way to build an effective dystopia is to generate mechanisms for efficiently cancelling people at a distance. No, I don’t mean getting called out for being a bigot on Twitter, I mean getting thoroughly unpersoned for arbitrary lack of compliance.

We dabbled with this with a terrifying eagerness over the course of the pandemic. Many of us dutifully downloaded surveillance tools with integrated freedom of movement passports, and it doesn’t take a huge leap of the imagination to see what these would be like on the blockchain, with all sorts of other compliance metrics from credit scores to good behaviour points.

There are nation states playing with this stuff and have been for a while and not just China. The EU’s Project GLASS is an all-in-one “eGovernance” system, which uses SBT, sorry, Wallets as a Service (WaaS). It’s got blockchains, dApps and the terrifying sounding “Artificial Intelligence Data Schema Transformer” to aggregate all your identity in one handy place on IPFS. This is designed to provide a “multidimensional, hybrid architecture that can be adaptive to the specific needs of public administrators.” On the face of it, this is a lovely benevolent system for aggregating all your handy documents, but it is also a means to centralise your entire personhood into one easily cancellable place.

You only need to imagine a world where access gating is switched back on to things like bank accounts, pubs, and trains and then imagine engaging in some kind of wrongthink that gets you on the EU naughty list, which is looking easier and easier by the day. Now your drunken tweets can get you eating out of bins until you complete processing.

Immutability

There’s no backsies on the blockchain–once it’s on, it’s on. This is an asymmetric information flow. This isn’t all that worrying if you have full control over it, but it can be a source of max tyranny if you don’t.

Every shitcoin and dodgy JPEG you’ve flipped is indelibly recorded in your transaction graph, but if you’ve used some dApp that’s also been used by the DPRK, you’re on the very naughty list. Well, your wallet is anyway. No biggie, just use a new one. In fact, cycling wallets is good op sec.

But wait, now your wallet has your soul in it and all your metaverse good guy points, and it can’t be transferred. There’s no going back and changing your mind about using that dApp; it’s done.

There’s any number of things you might not want indelibly stored on your record: maybe you voted yes on that proposal that was deemed to be an outrage by the DAO, maybe you dumped those coins…

You get the idea.

Transferability at least creates a layer of plausible deniability. If it’s changed hands multiple times, you have some argument that the soul isn’t actually you.

Sybil Resistance

If I were to wager a bet on the thing that drives us to max dystopian outcomes, it’s chasing perfect sybil resistance.

A sybil attack is basically any single actor setting up multiple accounts to spoof an appearance of multiple independent entities. There is absolutely no doubt that this is a monstrous problem for the internet. I’m fairly convinced that most social media apps are populated with vast networks of sybils used for nefarious means.

However, I still don’t think this is worth installing broad spectrum identity verification for everything, which nation states are actively pushing for.

Pseudo-anonymity is a fundamental human right.

This means letting go of the idea you can beat Sybils. You can’t. And attempting to do so leads you down dark paths.

Chasing perfect sybil resistance means…

Eyeball Orbs

The good thing about worldcoin is that we already know what the tool of terror looks like, and it’s a scary metallic biometric data harvesting orb blitz scaled across the planet with the promise of free airdrops and MLM prizes.

All we need is worldcoin to be an attestation mechanism for an SBT and now you really have bound this thing to your soul. No going back now.

All we need is biometrics + SBTs + social credit innovation for an interested nation state to go “ahhh that looks like a good idea”, and it’s bug dust and lockdown pods all round.

Please, please, please leave biometrics out of blockchains.

Zk Saves Us Tho!

Not yet it doesn’t. It just ain’t ready. I highly suspect we’ll have gone all the way balls deep into SBTs before a whiff of real privacy hits us. I also think this kind of stuff will always lag the real innovation. The proper privacy layer protocols are difficult to make and will emerge out of well ossified schemes that have landed on their endgame use case. That’s my hunch anyway.

In the interim, we should avoid attesting our university degrees and personal identifiable information onto tokens and stick to pure pseudo-anonymous stuff. Leave that game to the verifiable credentials community. For now.

Towards a (non-dystopian) Decentralised Society

To be absolutely clear, I love that this paper exists and it’s an important piece of work. It’s a unification of the social sciences with crypto that’s exploded the crypto zeitgeist into new territories. It’s also basically an articulation of what many of us have been dreaming about for a long time.

What I’m aiming to add is a word of caution and a warning not to uncritically jump into tokens that are actually bound to your soul. On the one hand, this paper makes it clear that it’s not necessarily “one soul, one person”, but in the same breath, it “dememphasize[s] identity separation as a primary way to protect participants from abuses and cancel culture.” It’s totally possible to bind a crypto wallet to you that you wish wasn’t. So be careful.

On a broader note, the cryptospace isn’t great at exploring use cases carefully. In fact, we tend to discover a thing and then exploit the shit out of it until it reaches an obscene degree of max scam until it dies and is replaced by something else. Largely, I think a lot of the thinking in the DeSoc paper is to kinda cut that game out by removing the secondary market. Only this time, instead of rug pulls its accidental dystopias we need to worry about.

Still, we intend to explore the use cases of SBTs with our prediction market work, which did end up with sybil issues. Also, the non-transferability means we can trust the market reputation earned by those identities to the point that we could potentially trust them with things like treasury decisions for FactoryDAO, or people could even take their on-chain proof of market knowledge to venture DAOs, which is super interesting.

Crypto is about to evolve more deeply into the social layer; it’s the phase of the market I’ve been waiting on for years and I know many others have too. As we move into this post-money crypto era, we’re going to start to pick up all the complexities of human sociality, and now more than ever, we need to adopt a critical stance to the directions we move in as a community. This is an exciting time and we’re in uncharted waters, but here be dragons.